Blur Lit a Fire, Don't Let It Burn Down the House

By Evan Hansen

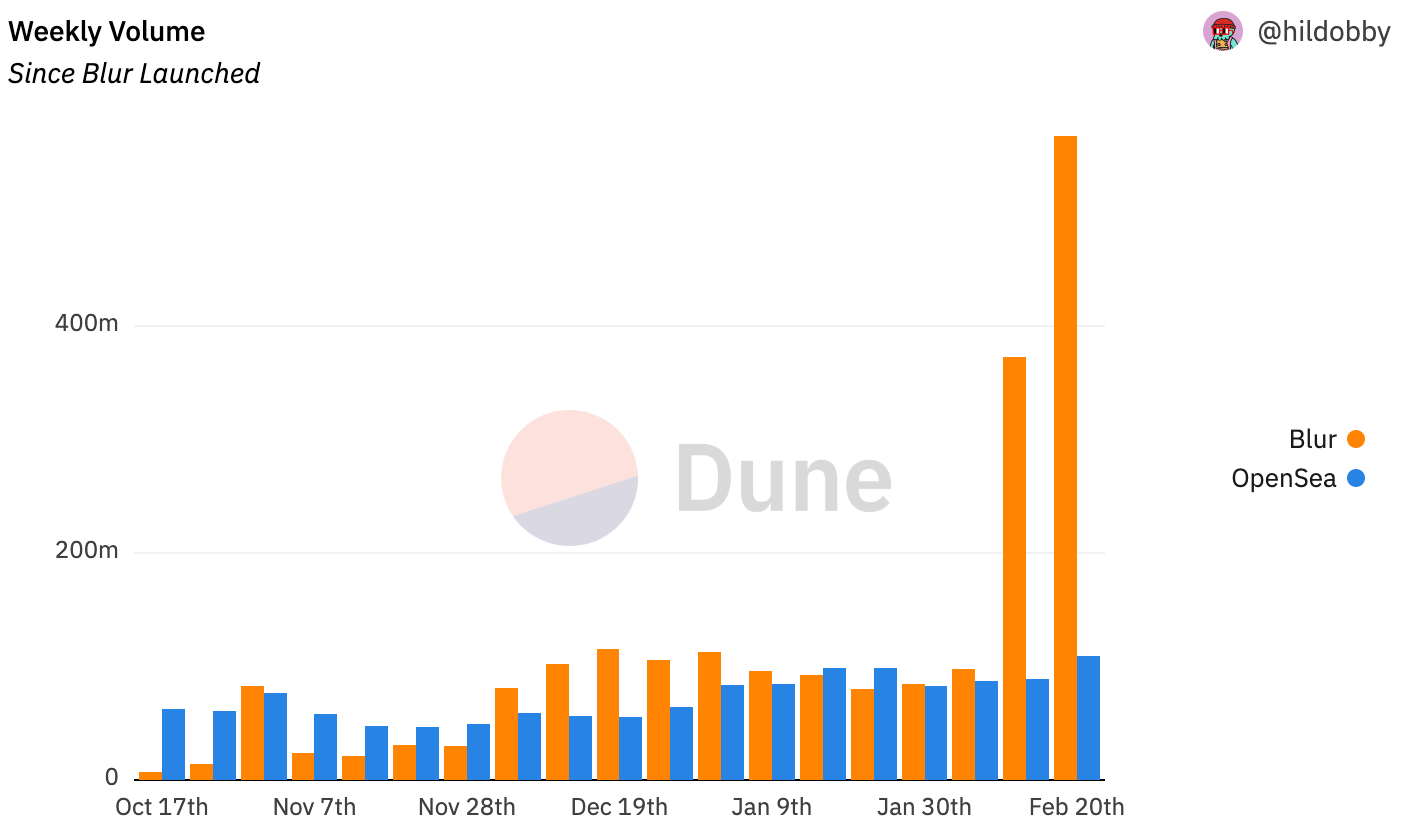

Blur has blazed its way to become the most active NFT marketplace by volume in just a matter of months, torching perennial leader OpenSea, which never really saw it coming. It's a first and it will have long term consequences for the NFT ecosystem regardless of who comes out on top.

Competition is generally good, so successful new entrants into the NFT market should be good. OpenSea has gotten away with some poor execution for years just because they got there first, so people have been waiting for something like this for awhile. Blur should be a welcome arrival.

But the story is more complicated than that. It pits not only two business rivals against each other, but two very different ideas of what NFTs are all about, and what sorts of behaviors platforms should encourage for the health of the ecosystem overall.

It's crypto, so people can pretty much do whatever they want, but this story is wild.

OpenSea got in on the ground floor, around 2017, and exploited very slow early adoption to amass a substantial lead by onboarding newbies and courting artists. No artists, no market.

It has its detractors, but it's fair to say it tried to balance NFT speculation with a more honorable creed, ‘It’s (at least partly) About the Art.’ There was some embarrassment inherent in its position about the cynical cash grabs that define the space for most outsiders, and an attempt to correct that by respecting royalties and artists rights, and in the process help try to legitimize NFTs eventually for mainstream adoption.

For some, finance is the least interesting thing about NFTs, and the coolest projects have little if anything to do with the get-rich-or-die-trying wing of the WAGMI party. (Though to be fair, the two are not mutually exclusive, as Jack Butcher's Checks VV projects shows. See Compress below.)

These people see a new medium pregnant with potential no less than oil paint and canvas, and they want to play with it. And it goes way beyond art, to how people connect, collaborate, do business, govern and on and on.

According to this world view (mocked by the right-click-save crowd), NFTs can be traded for profit, sure. But they are much more than a financial instrument, or another fancier type of crypto token. Their value is not equivalent to their floor price. Just like works of art, or units of social exchange, they can carry important cultural meaning and power. They have history.

Blur just flipped that philosophy on its head: No traders, no market.

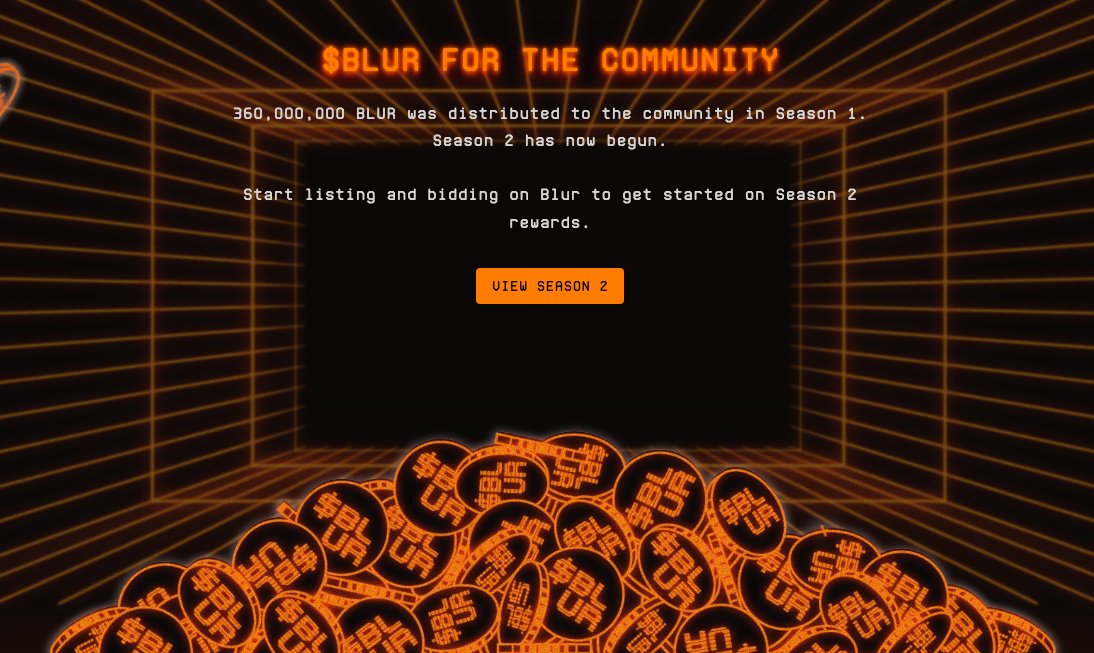

Blur built for pro flippers, charged no trading fees, opted out of royalty payments for artists, touted speedier transactions, and facilitated sweeps for buying many NFTs all at once at their lowest price, among other things. In other words, it nakedly courted speculation and greed, and accelerated that massively with airdrop token rewards bribes to encourage exactly that behavior.

It basically launched as the Advanced Settings tab in the NFT Traders App, and made all the buttons go brrrrrr. No one else was serving this customer well so they got a big bounce and deserved it, so one side of the story goes.

But. When they started getting traction, they used their momentum as leverage to try for total market domination. In their most recent update, they not only encourage people to use Blur but also to block OpenSea. Wallets with no OpenSea activity get bigger rewards bribes.

And they weaponized royalties.

Blur now pays out more royalties than OpenSea, after they instituted a policy that only those NFTs that list exclusively on Blur get them by default. Given the sequencing, one could be forgiven for wondering if this was granted in good faith, or only to further cement their market position. Positive market forces at work, justifying Blur's tactics, or irony? Does it even matter?

To fight back, OpenSea temporarily stopped charging fees itself and made secondary royalty payments optional. It's open warfare, and a race to the bottom. Artists will now need to wait at least until the fire is out to see where they stand. (One possible silver lining: the fight could accelerate moving royalties completely on-chain, where they're more expensive to maintain but more secure because marketplaces can't touch them, or use them as a bargaining chip.)

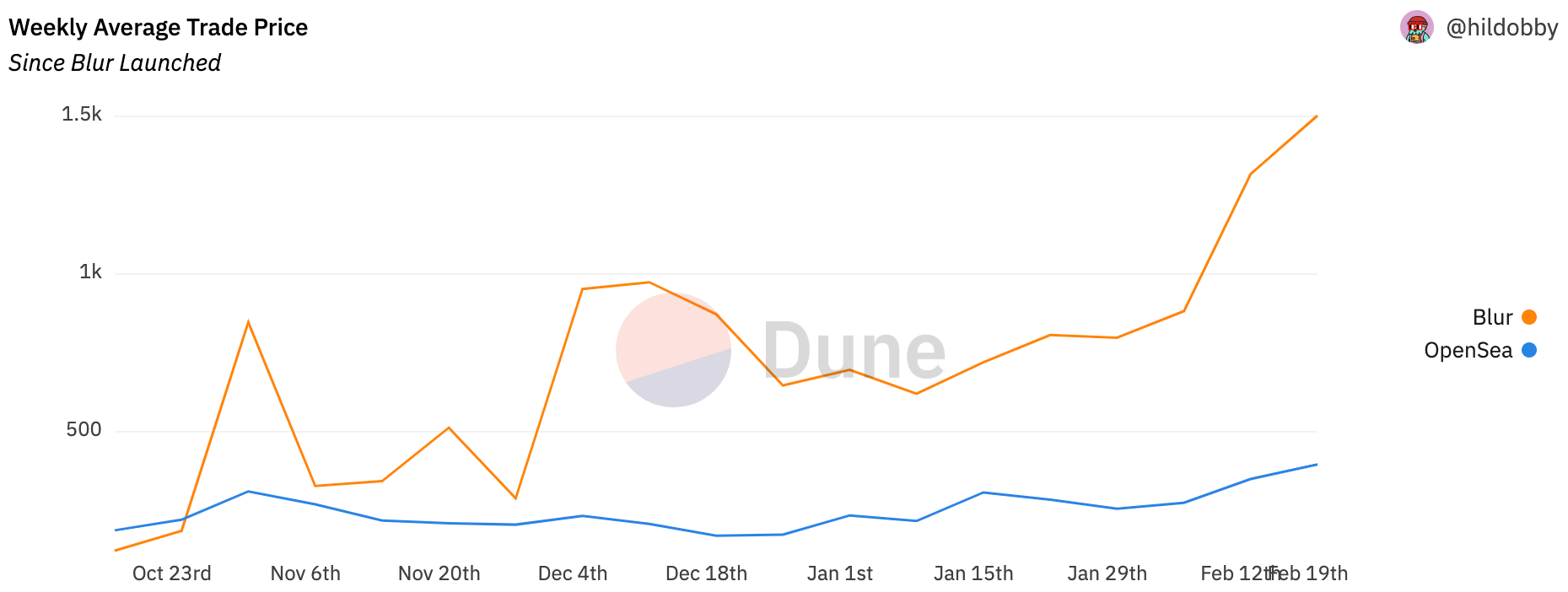

In the permissionless world of crypto, the only mechanism for restraint is the code itself and the behavior of the people who use it. So Blur is free to take its shot. It made a bet on greed, and it appears to be paying off. And it has a point, if the merch doesn't move, that's a problem. NFTs were in the doldrums. Since Blur announced its "Season 2" drop of 360M tokens, NFT activity has bounced back and liquidity has soared.

But. The increased activity in NFTs seems to be entirely people gaming the rewards bribes on Blur. There has not been an increase in the number of active wallets trading. This means there aren’t new people coming in, its just that the top traders on Blur have 1000x’d their activity. So the big boost in trading is most likely just a few whales shifting things back and forth, wash trading, and not a sign of more funds coming into the ecosystem, at least right now.

Even if this activity turns out to be more than a bubble, it comes at a cost.

It turns out some people want to melt down unique digital artifacts into gold bars, aka generic stores of value, and trade, baby, trade! That's fine, but careful what you wish for. Taken to the extreme, as some others have noted, this could turn a lot of NFTs into "shit coins with a JPEG attached," dilute other intangible values, and push the market even further in the direction of a slot machine.

In that game, the people who matter are high rollers with a gambling addiction, and that's not going to move NFTs to main street.

There are other markets. Blur and OpenSea are not the only options. But they now make up the largest share. How this plays out will have ripple effects as lessons learned become clearer, and the copycats come out.

Right now, the people who want short term profits, and to create the next bull run at all costs, are beating the people who want to build a long term and sustainable future. Let's hope they both wind up at the same place in the end.

It’s still early, but we will soon discover whether “greed is good” all over again.

Create

Yuga Labs, Creator of Bored Apes, Eyes Bitcoin Blockchain

As we noted in an earlier issue (we're always way ahead, btw, stick with us), NFTs can now be minted on Bitcoin using the new Ordinals protocol. This was already a very big deal, and now it's going to be an even bigger big deal.

Over 200,ooo Ordinal NFTs have already been inscribed on satoshis, the smallest unit of a Bitcoin, where they will live on chain forever as a long as a Bitcoin node is running somewhere in the universe. (We minted our very own highly collectible 1/1 Ordinals Meteor NFT cover almost two weeks ago – catch up!).

Most of these have been right-save-clicks of famous Ethereum NFTs. A complete set of 10,000 knockoffs of the OG CryptoPunks were among the very first to make an appearance.

With Yuga Labs entering the game, things are going to get hot. This will no doubt be a highly coveted drop, and only well-funded and very experienced players who know their way around Bitcoin and Ordinals are going to have a snowball's chance in hell of collecting. These are going to pop. The auction is said to be coming this week.

Why drop on Bitcoin vs Ethereum? Novelty, first and foremost. As one of the first Bitcoin NFT projects from a blue chip studio, one can already hear whispers of 'historic' in the making – and that's a good bet for keeping floor prices high sky for years to come. (For more insight on Ordinals listen to our recorded Twitter Space with OG NFT and Bitcoin experts Dennis Porto and Sean Bonner.)

Introducing TwelveFold. A limited edition collection of 300 generative pieces, inscribed on satoshis on the Bitcoin blockchain.https://t.co/aFWEIhzqcI pic.twitter.com/PjWABKKBr4

— Yuga Labs (@yugalabs) February 27, 2023

Compress

Checks by @jackbutcher are up 40,000% in just 7 weeks following their mint.

— Delphi Digital (@Delphi_Digital) February 26, 2023

Now, checks are being burnt by the community to create rarer and rarer editions.

An $8 open edition has made it's imprint in NFT history as on-chain art gets gamified: 🧵⬇️ pic.twitter.com/VH8dXEz4Ct

Web3 Gaming Draws Another Star

Former Apple executive Trip Hawkins, who founded the company behind the best-selling sports videogame franchise "FIFA", is joining a Web3 startup, looking to take on top blockchain games like Axie Infinity.

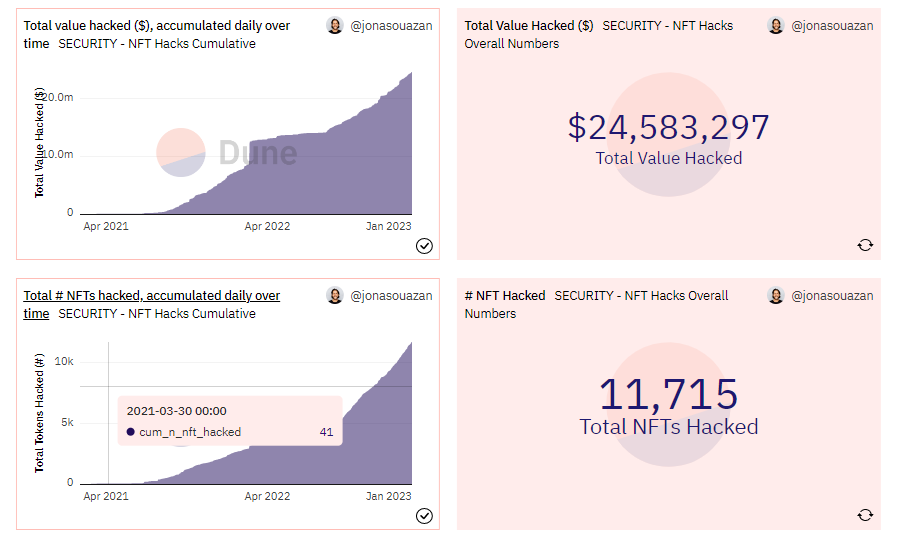

Another Day, Another Stolen NFT

A security team has created a dashboard to help the community detect potential NFT hacks on OpenSea, and track stolen goods. So far over $25 million in assets have been flagged. Retrieving them is another question.

Unity, Decentralized

Top gaming dev platform Unity has tapped MetaMask, Immutable X and Solana for a new suite of Web3 Developer Tools. Web3 projects like The Sandbox and Decentraland already use Unity. They and others can now choose between 13 different software development kits (SDKs) in Unity's new "decentralization" category.

Thanks for reading. How did we do today? We're trying different formats to make sure we become your essential read for understanding the new technologies transforming the creative arts and culture, from Web3 to AI and beyond. If you got this far, give us two more minutes of your time.